By John E. Kelley, CBSE, FMP

From the April 2023 Issue

Facility managers face an exorbitant amount of pressure today. Companies want to cut costs while skilled workers are becoming more expensive and harder to find. Tradespeople are aging, and the influx of new skilled workers is not keeping pace.

Headwinds come from external and internal forces, creating unexpected or uncontrolled pressure on businesses. Many times, these headwinds come in various shapes and sizes and from many directions, if not from every direction at the same time.

The following are some current examples of different corporate real estate (CRE) headwinds:

- Big tech firms are having mass layoffs. It is estimated that 140,000 positions were eliminated in 2022, and according to several news reports, another 64,000 positions were eliminated as of January 2023.

- Uncertainty about employees coming back to the office.

- Rising interest rates hitting a 17-year high.

- The labor shortage in many service industries.

- Overall uncertainty about the economy.

- Rising labor rates across most industries.

Taking these headwinds into consideration, what does this mean for corporate real estate? It means that brokerage transactions will likely be slow with these higher interest rates; clients will struggle getting staff to return to the office; thousands of empty desks in office buildings that were already experiencing low occupancy; and continuing operational costs for facilities, which are not going away anytime soon.

Since Integrated Facility Management (IFM) and their third-party suppliers are on the core list of trusted advisors for corporate real estate, what do these headwinds mean to these valuable partners? To start, these firms need direction and support from their trusted advisors in the IFM industry, and those IFM firms need direction and support from their trusted advisors in their third-party service provider relationships.

IFM providers and third-party service providers need to have open and transparent conversations about operational needs and cost reductions. Both need to understand that business as usual (BAU) is not what it was in 2019 and may never return to that status again. Things that most firms never wanted to do in their facilities now need to be considered and implemented.

Changing the way CRE, IFM, and third-party supplier partners work together to solve these tough issues and provide safe, healthy, clean, and sustainable facilities for their building occupants is the future. To achieve this, the industry must also throw in a healthy mix of creativity and agility in their operational delivery to help these firms and their CRE groups reduce costs while keeping the operational standards as high as possible.

Making Meaningful Changes

Now, with current headwinds in mind, how do CRE and IFM create meaningful changes and implement them to meet new goals and objectives?

To begin with, everything must be on the table: Restack office space, close unneeded floors in facilities, close underutilized facilities, and merge or combine departments into shared or flex spaces. This will reduce the amount of space needed to be managed and serviced, lower the firm’s carbon footprint and energy consumption, focus the FMs’ load on managing facilities that are at 50% occupancy or less, and help manage security requirements by reducing the number of floors being utilized for operation.

A bonus to this approach is that it leaves facilities in a positive operational condition where these spaces can quickly be reoccupied when the economy improves or when the client’s business expands. With a quick cleaning and refresh, those closed spaces are open for employees to move into and get productive. This could also generate revenue if an unoccupied facility or floor(s) is leased to another tenant, which could be an existing business partner or a completely different industry that is expanding.

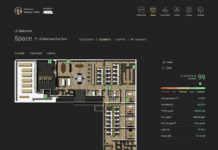

Once space utilization has been completed and companies occupy up to 70% or more of the available space, a second phase of their service evaluation can begin. This involves a janitorial service delivery evaluation, scope and frequency review, and the possible restructuring of the current janitorial service to meet the new needs of these now-occupied facilities. A few key items to focus on during these evaluations include centralized trash, enhanced recycling, sensor technology to drive porter services, occupancy space utilization, smart dispensers, and improved productivity; all these options can have a positive impact on cost and operational effectiveness while delivering best-in-class service at the highest optimal cost available.

Other areas that can help improve cost optimization and controls may require a small upfront investment; however, the ROIs will be seen quickly:

- Removing VCT and LVT from facilities is a quick way to reduce maintenance costs (average $.35 to $.55/sq. ft./occurrence), and the ability to polish and stain concrete can quickly change the entire look and feel of office spaces.

- Adding compactors and bailers for waste, recycling, and cardboard can improve the quality of materials and increase the value received from selling them with little or no contamination.

- Composting in facilities with full-service cafeterias removes wet waste from the compactors, reducing the weight being hauled from the facility.

- Compost services have also improved via containers that control smell and pest issues, allowing the compost to become fertilizer downstream.

- Revamping a facility to use LED lights will help drive down energy costs.

- Landscaping frequencies moved from once a week to every eight or nine days, depending on the region of the world the facility is in, can result in savings year over year.

These ideas and more can be brought into companies through corporate real estate and integrated facilities management to improve efficiencies, drive cost savings, and improve the sustainability efforts of the company, its occupants, and the community.

Workplace Sustainability: Employees Weigh In

Workplace Sustainability: Employees Weigh In

Firms’ CRE teams, IFM firms, and third-party service provider organizations are the experts in both real estate and service delivery management. This combined group is responsible for leading their firms through these uncommon, unexpected, or unavoidable headwinds.

As the trusted advisors for corporate real estate, and with the skills, tools, and knowledge to guide those who trust this industry’s experts, it seems that these headwinds can be and will be overcome, resulting in calmer times for firms, their partners in the CRE world, and everyone who touches business and corporate real estate.

Kelley is a Global Operations SME at JLL. He has spent 24 years in the janitorial industry as SVP, two years at CBRE as a strategic sourcing manager, and six years at JLL.

Kelley is a Global Operations SME at JLL. He has spent 24 years in the janitorial industry as SVP, two years at CBRE as a strategic sourcing manager, and six years at JLL.

Do you have a comment? Share your thoughts in the Comments section below, or send an e-mail to the Editor at jen@groupc.com.

![[VIDEO] Collect Asset Data at the Speed of Walking a Building](https://facilityexecutive.com/wp-content/uploads/2024/02/maxresdefault-324x160.jpg)